GET RID OF DEBT NOW!!

|

|

STOP HARASSING CALLS, GET YOUR UNSECURED DEBTS DISCHARGED

Chapter 7 and Section V Chapter 11 Bankruptcy filing gets you protection from Harassing calls due to the Automatic Stay. The Automatic Stay requires creditors to cease all attempts to collect once a bankruptcy is filed. Most people who file bankruptcy choose Chapter 7. The object in a chapter 7 is to keep as many of Your assets as You can, and get all of Your debts discharged. Chapter 7 is called “Straight Bankruptcy”, or “Liquidation Bankruptcy”. Each bankruptcy filing creates a fictitious entity which is called a Bankruptcy Estate. When You, You and Your Spouse, or Your business, file(s) a bankruptcy case, the filer, human(s) or business, is/are called the debtor(s). The bankruptcy estate will own everything that You or Your business owned upon filing, down to your socks, paper clips, and underclothes. There are limited exemption claims You may use to keep Your property, so planning is crucial. Dennis McGoldrick, a former trustee, can help You with exemption planning. A Bankruptcy Trustee is assigned to the Bankruptcy case, and the trustee is required to liquidate (i.e. “Sell”) all of Your property that the You cannot exempt, to pay creditors. Only about one percent of cases filed has assets for the trustee to sell. Most people who file can exempt all of their property. A bankruptcy lawyer can tell you if You can exempt everything you own, or what may be liquidated for your creditors. Chapter 7 relief was limited in 2005 by the addition of the Means Test (see below). Now, not everyone qualifies to file a chapter 7, so hire a lawyer to make sure you qualify. A case with nothing for the trustee to liquidate is called a no asset case. If you have no assets to liquidate, your case should be about four to six months from filing to discharge. If you have assets to liquidate, the estate may remain open for years. The U.S. Supreme Court has ruled that debtor's cannot remove a mortgage from their home, even if the house value has decreased, in a Chapter 7. Debtors must use Ch 13, or Ch 11 to remove unsecured mortgages. Call me, email me, I'd like to help you. 310-328-1001. New Section V Chapter 11 Now a person, or small business (with over 1/2 business debt) can elect to use Section V of Chapter 11 to confirm a plan more easily. The max debt that can be reorganized is $ 7.5 million. The plan has to be from 3 to five years long, and must pay the creditors the business's or human's net disposable income. This is much simpler than regular chapter 11, as there is no requirement that a class vote for the plan, and there is no absolute priority rule. |

GET YOUR PLAN CONFIRMED!

Chapter 11 (There is a new Section 5 Chapter 11. It is discussed at the bottom of the chapter 7 column) (See below left) Chapter 11 is the most complicated type of bankruptcy. It is used mainly to reorganize companies, but You may use it to restructure Your debts, or You and Your Spouse's debts. If a married couple's, or Your individual obligations exceed: $2,750,000.00 (the limits are the same for individuals and married couples) and an individual, or a married couple, wish(es) to reorganize, Chapter 11 is required. Most individuals, or married couples, use chapter 13 to reorganize if their debts are below the amounts listed above. Dennis McGoldrick has confirmed over 60 chapter 11 plans to reorganize individuals and companies. You can still use chapter 11 to remove/avoid an unsecured mortgage or deed of trust from Your residence. The rule is, liens can be removed, if more senior liens exceed the value of the house. Removal of a lien because it is unsecured is called a strip down. The confirmation of a plan, over the objections of creditors, is called a cram down. Chapter 11 is more complicated because Your lawyer must solicit the creditors to vote for your reorganization plan, and if creditors do not vote in favor, the rules for having a plan confirmed are complex. In a chapter 11 plan, creditors have to be classified. Creditors with different rights, must be separately classified (for example, a first lien on a home has much different rights than a second or third lien, and is nothing like an unsecured debt, each is separately classified.) The plan must be crafted so that at least one class will vote for confirmation. Confirmation is one of the great accomplishments in bankruptcy. If all classes vote to accept the plan, the plan will be confirmed. If one class does not accept, read below. In order to confirm a chapter 11 plan, classes of claims must accept the plan (each class only accepts if 1/2 in number of voters, and 2/3 of the Dollars voted, vote to accept). Your unsecured creditor class may be too large and dominated by one claim. We have to assume that one large creditor will vote against the plan. To force acceptance of a plan, a debtor has to request the court use the second part of the confirmation standards, which is called cram down. One of the requirements of cram down is the absolute priority rule. The Absolute Priority Rule says classes with a higher priority have to be paid in full before any lower class can receive/retain anything. The last two classes are: (next to last): Unsecured creditors, and (last): equity (or in a personal case, the human debtor(s)) As a result, unsecured creditors are often able to use the Absolute Priority Rule to prohibit the debtor(s) (you or your wife, or both of you) from retaining any property unless the unsecured creditor class is paid in full. I had to tell a Manhattan Beach resident she could not afford a chapter 11 because many of the houses in Manhattan Beach, her's included, had risen in value to over $3.0 million. She has insufficient income and can not afford to pay her creditors the extra million her house had gained in this market. She has to sell her house. There is one exception, called the, "New Value Exception". This requires the debtor pay new value to creditors. This is often done from exempt property, like a homestead, 401k, or other form of pension, which otherwise could not be reached by creditors. The amount that must be paid is roughly equivalent to the liquidation value of the estate. Estates with no equity or negative equity do not require much New Value to have a plan confirmed, but cases with substantial equity can be hard to reorganize without selling property to pay creditors. |

STOP FORECLOSURES, SAVE YOUR HOME, AND GET A DISCHARGE OF YOUR UNSECURED DEBTS!

Chapter 13 Chapter 13 is nicknamed "Wage Earner Reorganization." As stated in the chapter 11 column, the upper limits for debt in chapter 13 are: $2,750.000.00 Most credit cards are unsecured, car loans and home mortgages are examples of secured debt. If Your, or You and Your Spouse's debts do not exceed these limits, Chapter 13 is generally preferred. You can use Chapter 13 to restructure Your debts over 12 to 60 months (one to five years) (most use three to five years). However, if You or You and Your spouse, together, have income over the Mean, the case will be required to last 60 months. These cases require the You to make Your best efforts to repay creditors. You are required to take the means test to determine what percentage of unsecured debt must be repaid. You will want a lawyer to prepare the means test in a Chapter 13 case. If You are behind on house payments, car payments, whatever payments, a chapter 13 plan can give you up to five years to cure the loan defaults. Give us a call and we can outline a case for you. You can still use chapter 13 to avoid an unsecured mortgage or deed of trust from your residence. The rule is liens can be removed, if more senior liens exceed the value of the house. This removal of a lien because it is unsecured is called a strip down. In Chapter 13, the creditors Do Not get to vote on the plan. Most plans are confirmed upon the recommendation of the trustee. Confirming a plan over the objections of creditors is called a Cram Down. Yes, you can force creditors to accept your plan, if the plan is your best effort to repay your creditors (which, at a minimum, is all of your disposable income calculated by the means test), and you pay the creditors as least as much as they would receive if you were in a chapter 7. Debtors cannot extend house loans in a chapter 13. Use a chapter 11 to accomplish that task. BEWARE!! Reverse mortgages require the home owner to continue paying for property taxes and insurance. Reverse Mortgages have begun foreclosing on residences when homeowners fall behind on insurance or taxes. Credit Card Slavery is alive and well, it is now called "Chapter 13". |

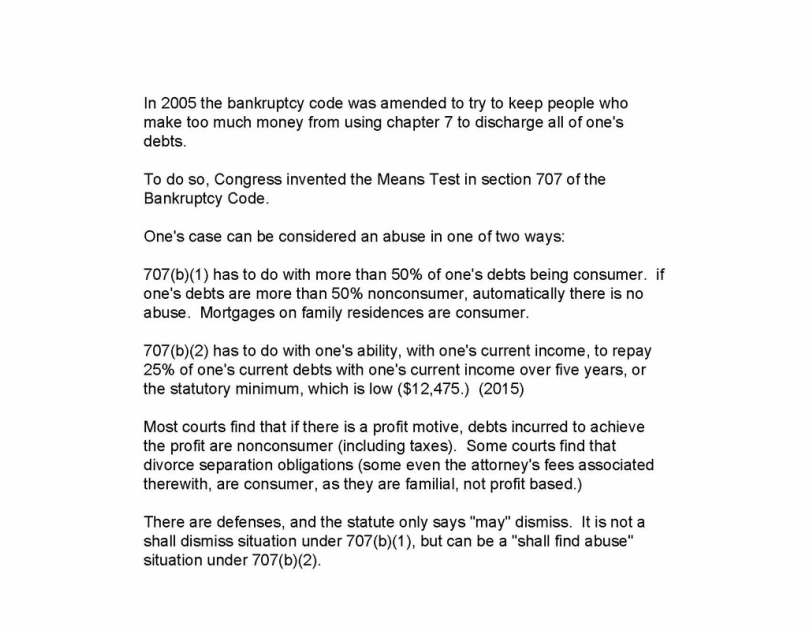

In 2005, Congress Invented Means Testing to limit some debtors' bankruptcy options.

The Means Test uses IRS allowed expenses to determine if you have enough Means to repay your debts. The IRS allowed expenses are minimal. The IRS measures average expenses for people on a county by county basis, and when considering how much anyone can afford to pay back taxes per month, subtracts the allowed expenses

from your income. It does not matter if your expenses are higher, too bad, cut your expenses*. The Means test now does the same thing, takes your average income, subtracts the IRS allowed expenses, and if too much is left over, finds that your Chapter 7 filing is an abuse of the bankruptcy system. You want no presumption of abuse if you want to file a chapter 7. Filling out the means test is a little like filling out a tax return, you don't want an amateur doing it for you. If abuse is presumed, you may have to use chapter 13 or chapter 11. Sadly, if one's income exceeds the mean, but the debtor is not subject to the means test, i.e. the debtor's debts consists of business debts, or dischargeable taxes, the US Trustee may use section 706 to try to convert or dismiss one's case. Contact us, we'll give you as straight a scoop as we can.--Dennis

Some people have to quit second and third jobs to pass the means test. If you don't, the government will force you to work 2 or 3 jobs for five years to repay your creditors. This new bankruptcy system is very hard on debtors who work two or three jobs. I have no idea how congress members passed this law. The means test is totally prejudiced against those who have taken on extra work to try to repay debts.

The means test is really just a way to keep people in credit card slavery. In 1978, when the bankruptcy code was first enacted, the legislative report said that people should be able to choose whatever chapter they wanted to file. The 2005 amendments put in the means test, and now people are routinely forced into indentured servitude to repay banks and other creditors. How did the banks get congress to re-enact slavery? Sadly, the courts have decided that denying people the opportunity to use chapter 7, and forcing debtors to use chapters 13 and 11, does not constitute involuntary servitude. Really?

It shocks me that the US government won't let people have bankruptcy protection. We are in a sad period of protection for banks which made "D" paper loans to individuals who are struggling, and cannot repay credit card debts. Credit Card Slavery is alive and well, it is now called "Chapter 13".

*Secured debts, have to be paid (or the creditor and move for relief from stay and collect the collateral), so the means test accepts the actual amount of secured debts. Other expenses have to comply with the published average expenses in your county.

from your income. It does not matter if your expenses are higher, too bad, cut your expenses*. The Means test now does the same thing, takes your average income, subtracts the IRS allowed expenses, and if too much is left over, finds that your Chapter 7 filing is an abuse of the bankruptcy system. You want no presumption of abuse if you want to file a chapter 7. Filling out the means test is a little like filling out a tax return, you don't want an amateur doing it for you. If abuse is presumed, you may have to use chapter 13 or chapter 11. Sadly, if one's income exceeds the mean, but the debtor is not subject to the means test, i.e. the debtor's debts consists of business debts, or dischargeable taxes, the US Trustee may use section 706 to try to convert or dismiss one's case. Contact us, we'll give you as straight a scoop as we can.--Dennis

Some people have to quit second and third jobs to pass the means test. If you don't, the government will force you to work 2 or 3 jobs for five years to repay your creditors. This new bankruptcy system is very hard on debtors who work two or three jobs. I have no idea how congress members passed this law. The means test is totally prejudiced against those who have taken on extra work to try to repay debts.

The means test is really just a way to keep people in credit card slavery. In 1978, when the bankruptcy code was first enacted, the legislative report said that people should be able to choose whatever chapter they wanted to file. The 2005 amendments put in the means test, and now people are routinely forced into indentured servitude to repay banks and other creditors. How did the banks get congress to re-enact slavery? Sadly, the courts have decided that denying people the opportunity to use chapter 7, and forcing debtors to use chapters 13 and 11, does not constitute involuntary servitude. Really?

It shocks me that the US government won't let people have bankruptcy protection. We are in a sad period of protection for banks which made "D" paper loans to individuals who are struggling, and cannot repay credit card debts. Credit Card Slavery is alive and well, it is now called "Chapter 13".

*Secured debts, have to be paid (or the creditor and move for relief from stay and collect the collateral), so the means test accepts the actual amount of secured debts. Other expenses have to comply with the published average expenses in your county.